Hat tip to Gideon Rachman, chief foreign-affairs columnist of the Financial Times, for providing a plausible answer to the question (Has China won?) I wrote about in the previous post. Easy to understand, argues Rachman, why China might be feeling its oats. It is opening up its economy after having [continue reading . . . ]

My friend James McCusker, tongue planted firmly in cheek, suggests that rather than just one trillion-dollar platinum coin as a solution to our debt-deficit-fiscal mess, we mint one worth $50,000 for each of us. That’s roughly 315 million shiny tokens. Poof! Our debt problem goes away. How do you plan [continue reading . . . ]

Don’t miss today’s New York Times obit of the 1986 Nobel laureate and George Mason University professor James M. Buchanan. Like everyone else, Buchanan taught, politicians tend to act in their own self-interest Courting voters at election time, for example, legislators will approve tax cuts and spending increases for projects [continue reading . . . ]

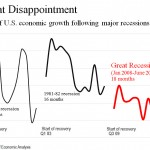

So we have just started Year 5 of N-ZIRP, the Fed’s near-zero-interest-rate policy, and it is working so well that the Fed will have to keep printing money. What’s wrong with this picture? In fact, despite a massive expansion of the Fed’s balance sheet, and some of the lowest interest [continue reading . . . ]

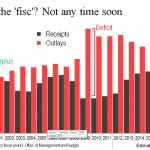

In the decade through Fiscal 2008, Uncle Sam spent at the rate of about 19.4% of U.S. gross domestic product (GDP), and took money in at the rate of about 18.3% of GDP, resulting in annual deficits of about 1.1% of GDP. In Fiscal 1999, at the start of that [continue reading . . . ]

Say what you please about Ben Bernanke’s unconventional monetary policies (quantitative easing, QE for short, and Operation Twist), they’ve been good for the stock market. The first chart shows that stock prices have roughly doubled, give or take a few percentage points, since Dr. Ben launched the first round of [continue reading . . . ]

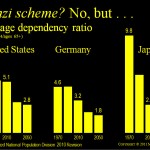

Fix Medicare, primarily by restricting end-of-life care, as insurance companies do now. Fix Social Security by minor changes to (1) the payroll tax, (2) the benefit formula for high-income beneficiaries and (3) the retirement age. Fix the hopeless hairball that is the U.S. tax code primarily by (1) broadening the [continue reading . . . ]

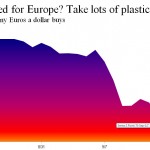

Martin Wolf, much-honored chief economics commentator of the Financial Times, has been my beacon during the financial crisis. So it is especially discouraging to read his June 6, 2012, column, headlined “Panic has become all too rational”. Wolf argues that the advanced economies are caught in a “contained depression,” that [continue reading . . . ]

Is Social Security a Ponzi scheme, as Texas Gov. and GOP presidential candidate Rick Perry labeled it during the GOP candidates’ debate Sept. 7? The answer is “No.” Charles Ponzi gave money collected from early suckers attracted by phony promises of high returns to new suckers after taking a cut. [continue reading . . . ]

I get a headache thinking about how much money Uncle Sam is borrowing — in the past year at the rate of almost $42 million a second (hat tip to the Financial Times blog Alphaville for calling this debt graphic to my attention). Think the U.S. is an outlier? Guess [continue reading . . . ]

The bad news is that the United States – indeed, much of the developed world – is in the midst of a “contained depression.” The private sector continues to de-leverage. Unemployment remains high. Pay for most is static or declining. Deflation remains a bigger threat than inflation. Depressions eventually end, [continue reading . . . ]

Oregon would have to increase taxes on each household by more than $2,000 each year for several years to fully fund the pension obligations of its public employees (those working for states, counties, cities, school districts, etc). By this measure, only in New Jersey and New York are the burdens [continue reading . . . ]