Hat tip to Gideon Rachman, chief foreign-affairs columnist of the Financial Times, for providing a plausible answer to the question (Has China won?) I wrote about in the previous post. Easy to understand, argues Rachman, why China might be feeling its oats. It is opening up its economy after having [continue reading . . . ]

That’s the title of a new book by Kishore Mahbubani, a Singaporean scholar, author and diplomat and former president of the United Nations Security Council. Subtitle: The Chinese Challenge to American Primacy. Mahbubani, the so-called “muse of the Asian century” per his Amazon blurb, is plowing familiar ground. Exactly two [continue reading . . . ]

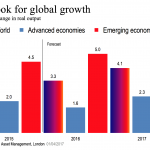

The global economy is likely to grow at between 3% and 4% in 2017 adjusted for inflation and differences in exchange rates. Emerging economies, led by Asia, are likely again to outgrow advanced economies (the U.S., Europe, Japan). That’s the word from one of the world’s most respected and widely followed [continue reading . . . ]

I can’t help but think what’s going on in global markets seems like a re-run of what happened in the fall of 2008, when Lehman Brothers failed, banks had to be bailed out and the worst recession since the Great Depression ensued. AP business writer Alex Veiga neatly sums up [continue reading . . . ]

Who would have guessed that incomes are more unequal in Communist China than in the United States? Not me. A new report from Peking University, cited in the Financial Times, says the richest 1% of China’s households own a third of the country’s wealth. The poorest 25% own just 1%. [continue reading . . . ]

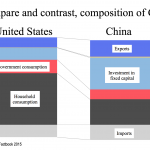

One of the main problems with China’s economy is that it is geared too heavily to exports and infrastructure spending, too little to domestic consumption. You can see the contrast with the U.S. in the chart. American consumers are in the driver’s seat in the U.S. Household consumption in 2014 [continue reading . . . ]

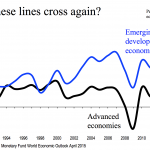

If you haven’t read it, get to your library (or use your library card) to read Ruchir Sharma’s op-ed in the Wall Street Journal August 17 (Page A 11). He argues that with advanced economies stuck in slow-growth mode, the globe is “one shock away from recession” and that the [continue reading . . . ]

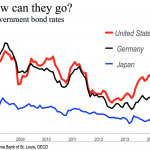

Why are interest rates so low? The best answer, says Martin Wolf, principal economics columnist of the Financial Times, is that the globe’s advanced economies remain in a “managed depression.” This is the phenomenon that former U.S. Treasury Secretary Lawrence Summers has in mind when he writes and speaks about [continue reading . . . ]

Worried about China’s property bubble collapsing and cratering the global economy? Relax. “China’s boom is over; but Beijing will avoid a bust.” Or so reads a headline on the back page of the May 13, 2014, issue of my favorite newspaper, the Financial Times. The column by Jay Pelosky of [continue reading . . . ]

The ports of Seattle and Tacoma are both spending heavily gearing up for shipping-container volumes vastly beyond anything they’ve handled to date. They both may be chasing pipe dreams that will prove costly to their taxpayers. Data from the Pacific Maritime Association shows that container “handle” at Tacoma peaked eight [continue reading . . . ]

I was a newspaperman before I became, in order, a newsletter editor-publisher, then a self-trained economist and professional speaker. I still love newspapers. And not just the on-line versions. I still savor dead trees. Four newspapers thud on to my front porch on weekdays, five on Saturdays, two on Sundays. [continue reading . . . ]

We have not seen this movie before. We do not know how it ends. Unwinding the Fed’s Quantitative Easing (QE) programs and central banks’ near-zero interest policies (N-ZIRP), now in Year 5, were never going to be easy. But these have to be done eventually. The repression of interest rates [continue reading . . . ]