Hat tip to Gideon Rachman, chief foreign-affairs columnist of the Financial Times, for providing a plausible answer to the question (Has China won?) I wrote about in the previous post. Easy to understand, argues Rachman, why China might be feeling its oats. It is opening up its economy after having [continue reading . . . ]

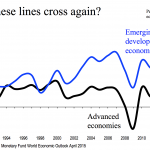

If you haven’t read it, get to your library (or use your library card) to read Ruchir Sharma’s op-ed in the Wall Street Journal August 17 (Page A 11). He argues that with advanced economies stuck in slow-growth mode, the globe is “one shock away from recession” and that the [continue reading . . . ]

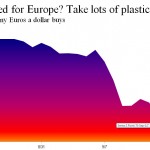

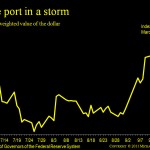

Headed for Europe soon? Your timing couldn’t be better. The dollar is up almost 15% against the currencies of major U.S. trading partners in six months, and almost 29% since July 2011. The currencies in question are the euro, the Canadian dollar, the Japanese yen, the United Kingdom pound, the [continue reading . . . ]

Say what you please about Ben Bernanke’s unconventional monetary policies (quantitative easing, QE for short, and Operation Twist), they’ve been good for the stock market. The first chart shows that stock prices have roughly doubled, give or take a few percentage points, since Dr. Ben launched the first round of [continue reading . . . ]

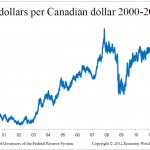

That’s the headline on Page 1 of the Seattle Times today. The article reports that some residents of the Bellingham area, an easy drive from the Canadian border, are grumbling that Canadian shoppers are overcrowding the parking lots of Costco Wholesale and other box stores on the U.S. side of the [continue reading . . . ]

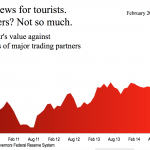

Gas at $4.00 a gallon? Gold at nearly $1,800? One of the reasons is that the value of the U.S. dollar has fallen by 38% in a decade, measured against the currencies of major trading partners. The collapse of the dollar to 97-lb. weakling status has been a drag if [continue reading . . . ]

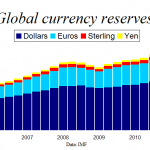

So you think the dollar is washed up as a reserve currency, destined to live up to the jibe “American peso.” Better whip out your library card and retrieve the column of Mansoor Mohi-uddin, managing director of foreign-exchange strategy at UBS, on Page 22 of the Financial Times May 11, [continue reading . . . ]

Is the dollar’s long run as the global reserve currency coming to an end? It is if the Chinese have anything to say about it. China owns the globe’s largest store of dollar-denominated assets outside the U.S. Understandably, it wants to diversify. The world needs an “international reserve currency that [continue reading . . . ]