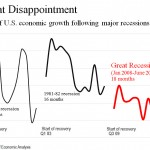

So we have just started Year 5 of N-ZIRP, the Fed’s near-zero-interest-rate policy, and it is working so well that the Fed will have to keep printing money. What’s wrong with this picture? In fact, despite a massive expansion of the Fed’s balance sheet, and some of the lowest interest [continue reading . . . ]