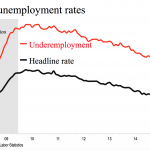

Friday’s jobs report showed the U.S. headline unemployment rate has fallen to 5.4%, the lowest since mid-2008. Good for us, but hold the applause. The underemployment rate, including those working part time involuntarily, remains relatively high (10.8%) for this stage of the recovery. It has been nearly six years since [continue reading . . . ]