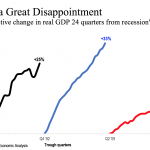

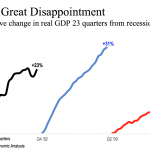

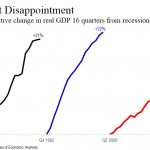

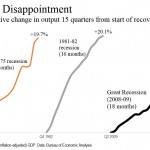

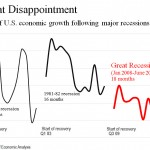

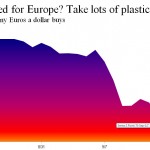

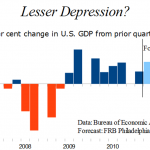

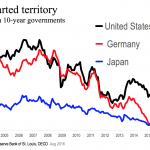

For a quick economic update for members of Bellevue Rotary recently, I updated several slides I usually include as a part of my talks and added a new one or two. You can download all of them as a PDF file here. Among bullet points: We live in a slow-growth world. [continue reading . . . ]