Gas at $4.00 a gallon? Gold at nearly $1,800? One of the reasons is that the value of the U.S. dollar has fallen by 38% in a decade, measured against the currencies of major trading partners.

Gas at $4.00 a gallon? Gold at nearly $1,800? One of the reasons is that the value of the U.S. dollar has fallen by 38% in a decade, measured against the currencies of major trading partners.

The collapse of the dollar to 97-lb. weakling status has been a drag if you favor German cars, French wine and August in Tuscany.

But it has been music to U.S. exporters’ ears. A weak dollar makes U.S. exports more competitive, and raises the price of imports — unless, as in the case of China, import currencies are pegged.

Pacific Northwest farmers and growers love a weak buck. So does that sales team at Boeing. Airbus hates it; it prices in dollars, but has to pay in euros.

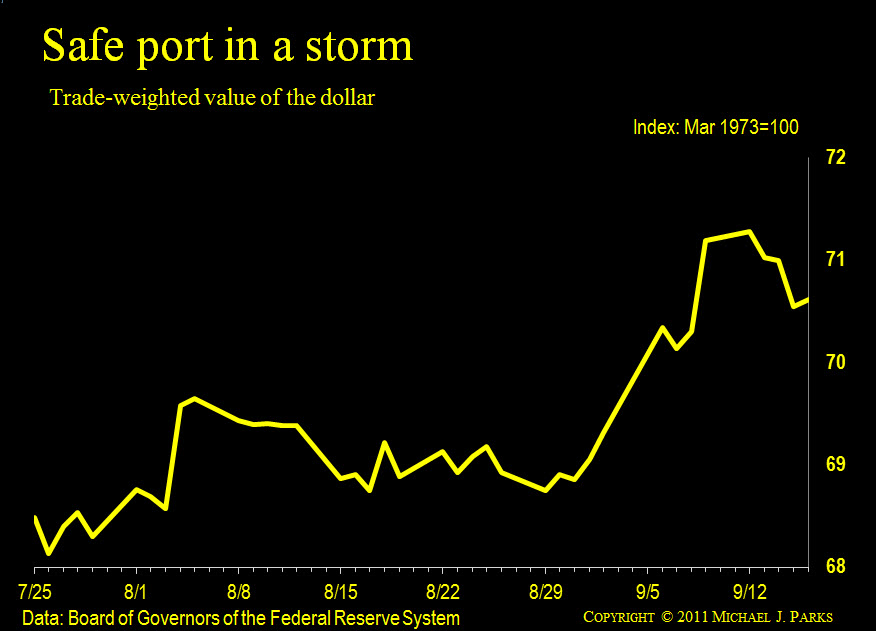

The punch line: With Europe seeming to unravel, the dollar has suddenly become a safe haven. At the end of last week, it was up nearly 5% on a trade-weighted basis from the low at the end of July.

The stronger dollar will help at the gas pump, but be careful what you ask for.

A suddenly muscular buck is bad news for the export sector of the U.S. economy, one of the bright spots in this dreary recovery (or Lesser Depression). It is certainly bad news for the export-oriented Pacific Northwest economy.